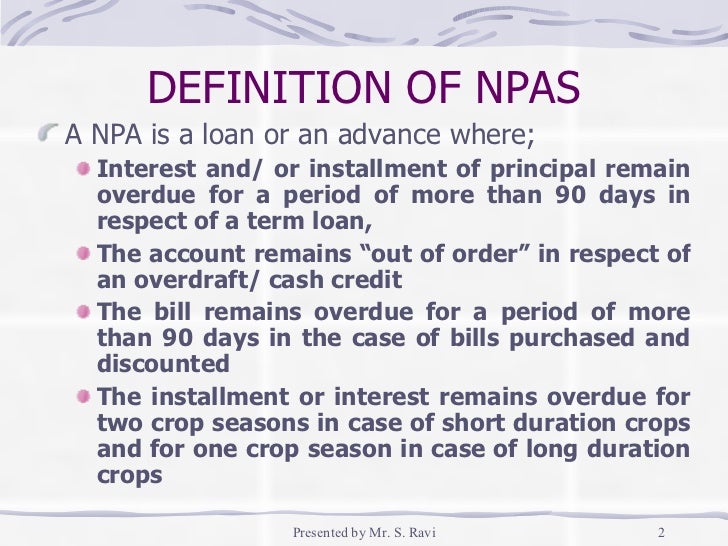

A number of loan providers will offer financing choice the moment 1 day of release

- Begin using credit once again reduced. Providing credit cards just after bankruptcy proceeding might be difficult, but you can find alternatives for you. Avoid using an excessive amount of borrowing too fast, however you will be capture short measures on rebuilding your credit rating if you are paying costs timely and you can opening a protected mastercard.

- Steer clear of the exact same economic problems one to got you towards this situation. An individual will be qualified to receive a mortgage, loan providers look within exactly why you found myself in this case and try to conclude if this sounds like planning to recur. This is certainly the real difference when you look at the qualifying for a financial loan otherwise maybe not.

Bankruptcies is released within differing times with regards to the type. A part seven bankruptcy proceeding is commonly released on the five months (normally) once you document. not, Chapter thirteen bankruptcies is pull to the having much longer as you will be anticipated to pay back your own agreed upon repayment plan. Usually these bankruptcies is discharged less than six many years following Part 13 case of bankruptcy is actually submitted.

New better you are able to personal bankruptcy launch, the greater delighted you will probably be to own now of life at the rear of your. However, it is not when to help you ignore your finances. Actually, this new six months prior to your own case of bankruptcy discharge are crucial for debt upcoming.

A few lenders will offer financing choices once eventually out of discharge

- Reassess your financial budget. You should be keeping track of your credit report and you will staying at the top of one’s cover the size of your case of bankruptcy. But half a year prior to launch, you may also reevaluate your financial budget and bills. Make sure you are in for victory as discharge occurs plus bankruptcy proceeding fee drops away from.

- Keep preserving. Now could be maybe not the time to end rescuing your bank account. The greater offers you have after their bankruptcy launch, quicker you are able discover right back on your ft.

- Review credit history to own accuracy. Repeatedly, completely wrong recommendations could well be showing in your credit history which could keep you from being qualified or reduce your own closing.

- Opinion predischarge publication to get more skills. View the Guide

Ideas to assist your money 0-one year immediately following bankruptcy discharge

So, you’ve ultimately had their bankruptcy released. It is an enormous moment for everyone. Well-done! You should actually have a far greater month-to-month cashflow and a bona fide sense of fulfillment. You are today probably qualified to receive specific mortgage applications, but many lenders will continue to have guideline overlays which need an excellent one- otherwise one or two-12 months wishing symptoms. Traditional and you can Jumbo loans doesn’t feel readily available if you don’t is actually 2-cuatro decades earlier launch.

A few loan providers will provide loan alternatives the moment 1 day of discharge

- Keep a designs. Don’t let the production of the personal bankruptcy will let you fall back to crappy economic models. Follow good budget, pay your bills timely, and you will reduced reconstruct your credit score.

- Screen your credit history. Understanding where your credit score stands is a great cure for make fully sure your earnings are produced upwards correctly. Of many finance companies otherwise credit card companies has credit overseeing software to own free. Use them to stay towards the top of your own borrowing during this important day.

- Keep bankruptcy proceeding documentation. Because of the a year shortly after a personal bankruptcy release, you will be lured to throw out the case of bankruptcy documents. Cannot do that. That it documents comes in useful if you are happy to apply for a home loan.

- Do your best to remain in a reliable domestic and business. Staying a reliable household and you may business might help reveal creditors you to you are https://paydayloancolorado.net/milliken/ a secure bet. Sometimes the unexpected happens and you may property otherwise jobs need to be left. Although not, do your best to save a constant household and business situation toward first couple of years just after your bankruptcy proceeding release.